Rent vs Buy Calculator: Should I Rent or Buy?

Table of Content

These include property tax and home insurance expenses. If the home is part of a condo unit, then there are also condo fees. People who own homes usually can leverage that asset to make a larger down payment on their next house. Rents increase on average about 3% to 5% annually, depending on geographic location.

In these three cities buying a home only makes financial sense for those who can stay put for at least 14 years . When you buy a home, you’ll pay for legal fees, home inspection fees, and land transfer taxes. When you sell your home, you’ll pay a real estate agent (typically 4-6% of the total sale price) to find buyers, and negotiate / close the deal.

How Long You Have to Live in America’s Biggest Cities for Buying to Make Sense

In some areas of the U.S., rent prices can change drastically over the course of just a few years. What may have fit your budget a year ago might not now if your landlord hikes the rent when it’s time to renew. Sometimes you don’t have the luxury of waiting until your house sells to move, which is another headache you avoid as a renter. Many renters, for example, enjoy the flexibility of being able to change apartments and neighborhoods at the end of their lease. If you no longer like the area you live in or have to move for a job, renting makes life much simpler. Down Payment will help us generate your monthly costs of owning a home.

The most common mortgage terms are 15, 20, and 30 years. Check your refinance options with a trusted local lender. You can deduct home mortgage interest on up to $750,000 of mortgage debt.

Social Security & Medicare

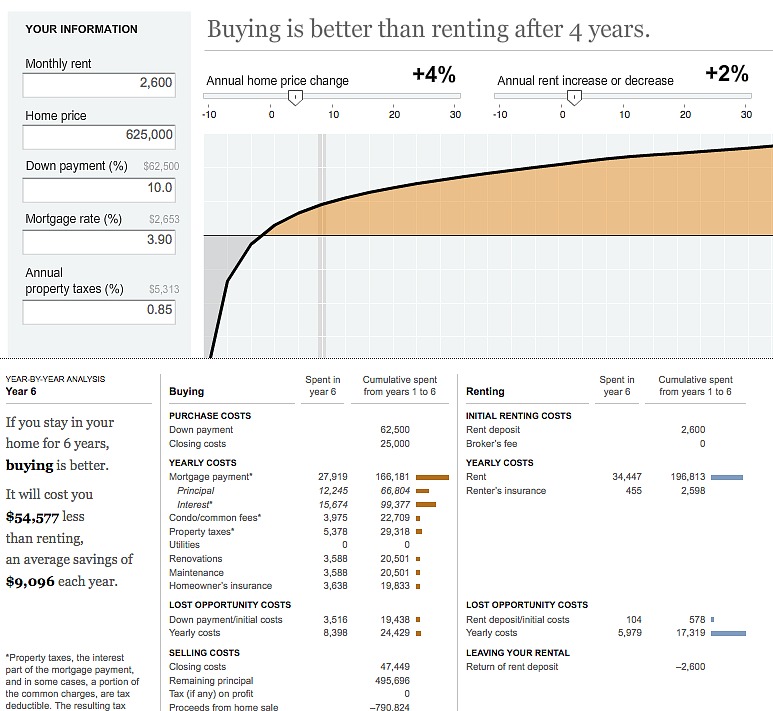

When comparing the two options, renting can often come out ahead, at least compared to the early years of a home purchase. But like the tortoise racing the hare, owning a home is more “slow and steady,” a marathon instead of a sprint. The virtues of buying grow when you stay in a home for a while. As the years pass and your home’s equity and value have a chance to build, less of each mortgage payment is used to pay off interest and more goes toward your principal.

Monthly rent increases add up over time compared to a mortgage, which stays the same each month, assuming you have a fixed mortgage rate. If you’ve always dreamed about purchasing a home, there are many financial benefits. Additionally, there are first-time homebuyer programs that help with the upfront cost, such as assistance with down payment and closing costs.

Member Benefits

Standard deductions for 2021 are shown in the table below. Most taxpayers do not itemize their taxes & instead choose to take the standard deduction. For each county, we calculated the breakeven point in the buy vs. rent decision — the point at which the total costs of renting become greater than the total costs of buying. The counties with the shortest amount of time needed to break even are the best places to own a home. In these four western cities, the weather is great, populations are growing quickly, and renting usually beats buying. Average home prices in these cities aren’t quite as high as in the tech hubs or New York, but they are still outside the range most residents would consider affordable.

Shopping for a home and shopping for a mortgage are two complex — and completely different — worlds. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Upon moving in, take pictures of the apartment to evaluate its condition. If the landlord tries to charge for damages to the property, the lessor holds proof of the property's pre-existing condition before the move-in.

Connect with a lender

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. Percentage of the monthly “common fees” that is tax deductible.

Mortgage, home equity and credit products offered by U.S. Bank National Association and subject to credit approval. Closing costs when you sell your home include any type of agent commission.

Find answers to the question “is buying a better option for me than renting? ” and determine whether home ownership seems right for you. The Rent vs. Buy Calculator uses the everyday costs of renting and buying to compute and refine results.

Property taxes add extra expense to a monthly mortgage payment. For example, a property tax bill that is $3,500 annually adds up to around $292 each month. This is the amount of property taxes you expect to pay each year. This information is normally found in a home's listing, which can be found online or at a local real estate agency. The Big Apple’s housing market is notoriously competitive, and indeed, SmartAsset’s research shows it is the worst urban market for homebuyers in the country. Good deals are nearly impossible to come by and when an attractive option appears on the market, it is often snapped up in days if not hours.

The following is the average cost based on the length you stay for the next 30 years. It protects you from damage to your home or possessions. Homeowners insurance also provides liability insurance against claims by people who might be injured due to accidents in your home or on the property. Home equity Talk to a lender to see how much you can access. Also check other intangible factors given below, that affect your decision of Renting or Buying a home. Simply fill in all the fields below, using your best estimate when unsure.

In today’s economy many people move to different cities every 2-3 years to explore better job prospects. If your time horizon is short term and if you are unsure of the city you want to settle in, renting is a better option. Stability – While renting, you are always bothered about rental increases or when your landlord may decide to sell the house. If you stay in your own house, you don’t have to worry about such issues. This Rent vs Buy Calculator is a comprehensive excel based calculator that can help you in resolving your dilemma of renting vs buying a home in India. This calculator takes into account all major factors and is always updated so that you get the most accurate results.

From 1963 to 2019 the median home price in the United States rose from $18,000 to $321,500, compounding at 5.28% annually. Over the same time period the average US home price increased from $19,300 to $383,900, for a 5.48% compounded annual rate of return. When you rent, your landlord is responsible for making repairs & insuring the property. When you own a home, you have to make them, and they can occur at any time and without any warning. You could find yourself thousands of dollars in debt — or living in a cold, damp house.

When buying a condo the homeowner is still responsible for most of these types of repairs & must pay HOA dues. However, from a purely economical standpoint, deciding whether to buy or rent a home may not always be so black and white. Your current financial circumstances and the state of the current housing market both play a big role in determining what is the right choice for you. Traditionally the most affordable parts of the country , Texas and the south lived up to their reputation in our analysis. In every major southern or Texan city we examined, the average resident would recuperate the up-front costs of homebuying within just four and a half years of closing. That said, many renters complain of unresponsive landlords who refuse to deal with things like bad plumbing or a faulty fridge.

Comments

Post a Comment